Blog / Automation Technology, Insurance, Microsoft

Insurance Use Cases: Microsoft for Business Process Automation

If you are considering transitioning your insurance agency from your current workflow to an automated workflow, you aren’t alone. However, many agencies hold back because they’ve heard that automation requires a complete revamp of existing processes and software. Fortunately, insurance process automation can be accomplished with the software you’re currently using, including Microsoft.

Microsoft 365 can be the backbone of your insurance company’s internal and external transactions, including:

- Customer onboarding

- Customer service

- Employee onboarding

- Policy underwriting

- Claims management

Plus, there are internal processes that need to be completed to comply with insurance regulations that can be automated for Microsoft.

Related read: Best Ways to Optimize Microsoft Dynamics 365 for Insurance Agents

Why You Should Use Microsoft for Insurance Process Automation

Contrary to what you may have heard, insurance process automation using Microsoft products is absolutely possible, making it easier for the various tools to work together. There are several ways Microsoft products, when used for insurance process automation, can improve your business’ functions.

- Better Customer Experiences: Compile a complete customer profile in a single record. There is only one access point, so you can better assist your customers and work proactively with all of the information at your fingertips.

- Security: Prevent data breaches and malware so that you can protect your data and your customers’ privacy. Enterprise-level security is possible.

- Competitive advantage: Customize your Microsoft products for your business, and integrate with other insurance applications for seamless data transfers that improve the workflow and grow your business.

- Document management: Create and locate documents that you need internally and that your customers need.

How to Use Microsoft for Insurance Process Automation

How to Use Microsoft for Insurance Process Automation

Microsoft 365 applications that can be used and integrated together to help you achieve your insurance automation transformation include:

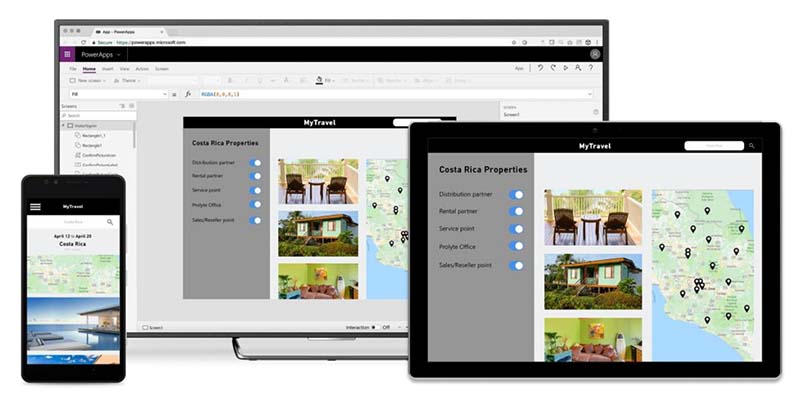

- Power Apps

This platform allows users to create apps from a template or from scratch without the need for extensive coding knowledge. The program allows you to connect over 200 data sources from a variety of well-known service providers including Microsoft, SalesForce and ZenDesk to name a few popular tools. With Power Apps you can also pull data in from where it’s stored such as Azure Cloud Services, Oracle or other sources to present the information no matter where it’s located. This Microsoft feature allows insurance organizations to build custom applications for their unique needs, such as giving customers access to a mobile app where their claims files can be uploaded.

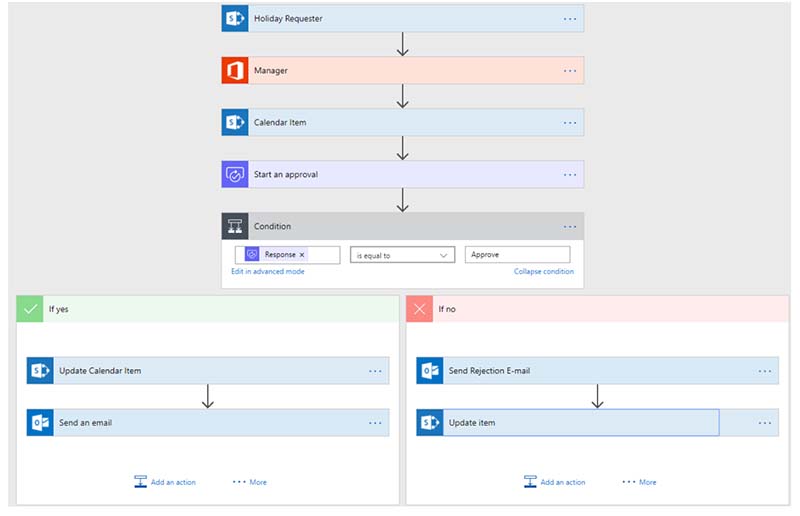

- Power Automate

Power Automate allows anybody to build automated processes for repetitive tasks by utilizing low-code/no-code drag-and-drop tools and hundreds of prebuilt connectors. Included with most Microsoft 365 licenses, this tool can connect to Microsoft tools including SharePoint and other services such as Salesforce, and Dropbox to automate your internal workflow with data being worked and placed into the appropriate systems just as it was done manually before. Time-intensive processes - such as underwriting, policy research and customer outreach - can now be done in the background while agents focus their time on processes that require their expertise.

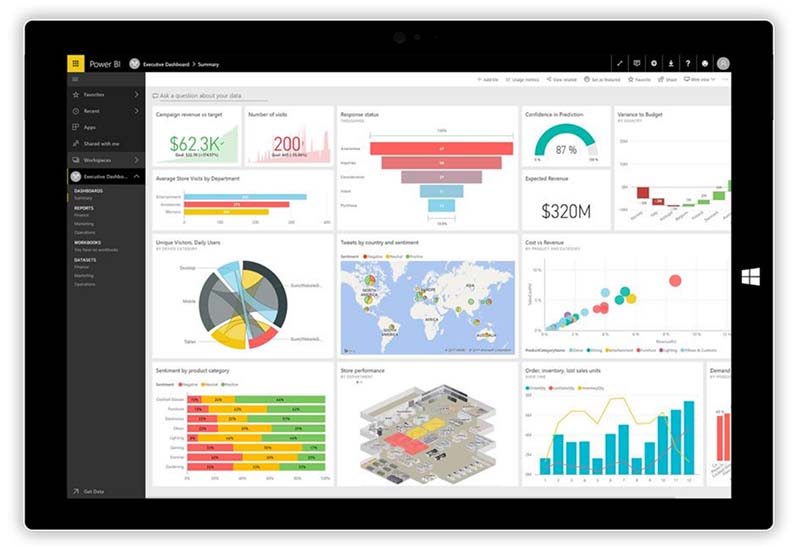

- Power BI

There is a lot of reporting needed from every department of an insurance company. This product creates reports and allows you to generate custom dashboards from more than 200 different systems. You can pull data from your organization, including Excel spreadsheets, to provide informative and up-to-date reporting. For example, this can help an insurance company review monthly percentage of policy issuances by region.

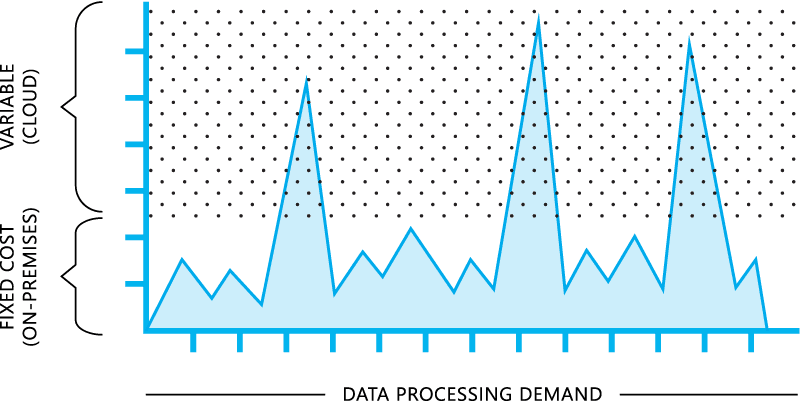

- Azure

Microsoft Azure houses many different services under one umbrella. For insurance, it’s often used to automate the risk assessment process of underwriting an insurance policy. The flexible capacity of Azure allows you to scale up and down server resources as needed. It’s also useful for expanding your storage services by offering a cloud solution.

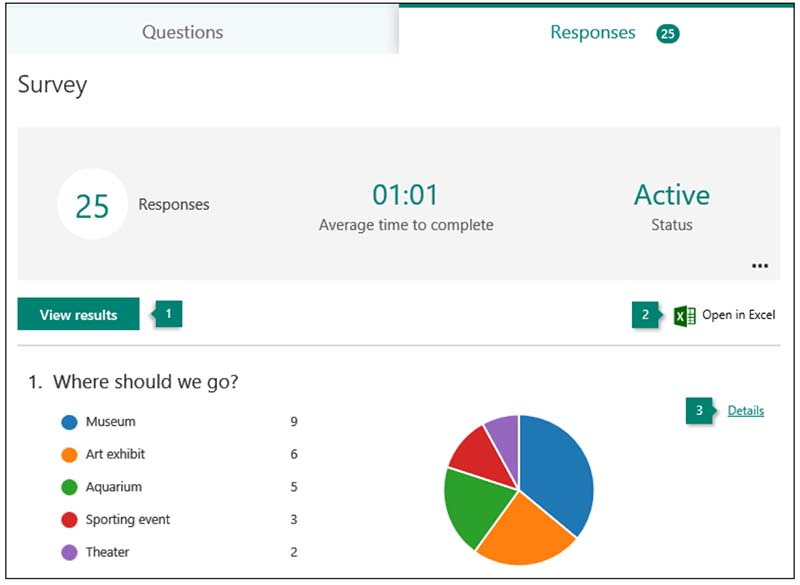

- Microsoft Forms

This product can help your users compile information from internal and external sources by creating quizzes, surveys, and polls. There are several different types of questions and answers possible. Microsoft Forms also allows you to add branching to surveys for more refined data from your target or segmented audience. This is a great way to collect information needed from new customers for online insurance policy sales.

Digital automation with Microsoft can also bring in data from legacy systems such as InfoPath, Designer, and Access Services.

You may also be interested in reading: How to Use Microsoft Products to Automate Insurance Processes.

What to Expect from Your Insurance Agency’s Microsoft Product Implementation

Determining which products you need, and which you need to work together to automate insurance processes, is a major portion of the automation process. And it’s a critical step in the process that deserves analysis before starting.

IT teams can often be too overwhelmed (and understaffed) to plan and create automation between business applications that can give your insurance company the edge it needs. If your team isn’t knowledgeable in the automation tools and planning process, a consultant can help.

Investing in both the software and the consultants needed to implement automation for an insurance agency is a big financial consideration. But the benefits of this investment have proven to be well worth it for insurance agencies that have already taken this step. The top two benefits that agencies experience after going through the transition are:

- Reduced costs/Increased Profits - By eliminating redundant processes and streamlining the workflow, your employees won’t waste valuable time. And fewer temporary employees are needed during peak times for data entry.

- Increased revenue - Because you have removed obstacles for underwriters and the sales team, you’re able to act faster on leads. You can even automate the process for new policies to be generated so that you can instantly capture new customers online.

As a Microsoft partner, Integratz helps insurance companies automate various Microsoft products and other important software. This is done in coordination with the IT team and each department to manage the data better. This creates efficiencies that lead to company growth.

If you’re ready to get off of the sidelines while you watch your competitors grow, call now for a free consultation. Integratz can give you the leverage you need to bring your insurance company into the age of automation.

Other Resources:

Integrātz is Dallas-based high-performance IT consulting and automation company specializing in AI-powered automation, systems integration, and data orchestration. Established in 2017, the company helps enterprises unlock agility, efficiency, and competitive advantage without costly system overhauls.

With global delivery capabilities and a nearshore hub in Viña del Mar, Chile, Integrātz partners with organizations at every stage of digital maturity to drive meaningful, measurable transformation.