Blog / Process Intelligence, Insurance, Microsoft

Best Ways to Optimize Microsoft Dynamics 365 for Insurance Agents

As more insurance agencies advance into the digital world, and the standards of service elevate, the tools available to the industry continue to grow and evolve in order to meet the demand of these new standards.

A leader in the digital world, Microsoft has ensured that their Dynamics 365 platform is one of the most dynamic and versatile options an insurance agency has to build upon when transforming the way they do business. Through their work with insurance companies and other customers in the Financial Services industry, they’ve even developed an Insurance Accelerator to help get companies moving with their platform right out the gate.

How can You Use Dynamics 365 for the Insurance Industry?

Dynamics 365 is a platform designed with customization in mind. Microsoft is helping Insurance companies redefine the way they do business by empowering them to engage more effectively with other agencies, follow defined and consistent procedures, gain insight on agent performance, and even leverage AI to improve any interactions within the agency.

To do this more efficiently, Microsoft has fully integrated their Common Data Model (CDM) infrastructure within Dynamics 365. Once the system has been set up properly, CDM can consolidate all company data, resources, and information into one uniform platform, allowing readily available access for management and agents alike.

Once the data is organized behind-the-scenes, processes that were once fully managed through employee knowledge and training can now be defined and streamlined into automated workflows that can be performed and monitored within the 365 platform.

For example, policy research and issuance is something that almost every agent will have to perform during the work week - but how each agent personally moves through the steps of that process can differ a lot. With Dynamics 365, policy issuance can be worked using a uniform, consistent process that the agents can access directly from the platform. This ensures that all bases are covered, e.g. no customers are overlooked, information is centralized, and the chance of mistakes is reduced.

What is the Insurance Accelerator within Dynamics 365 for Insurance?

What is the Insurance Accelerator within Dynamics 365 for Insurance?

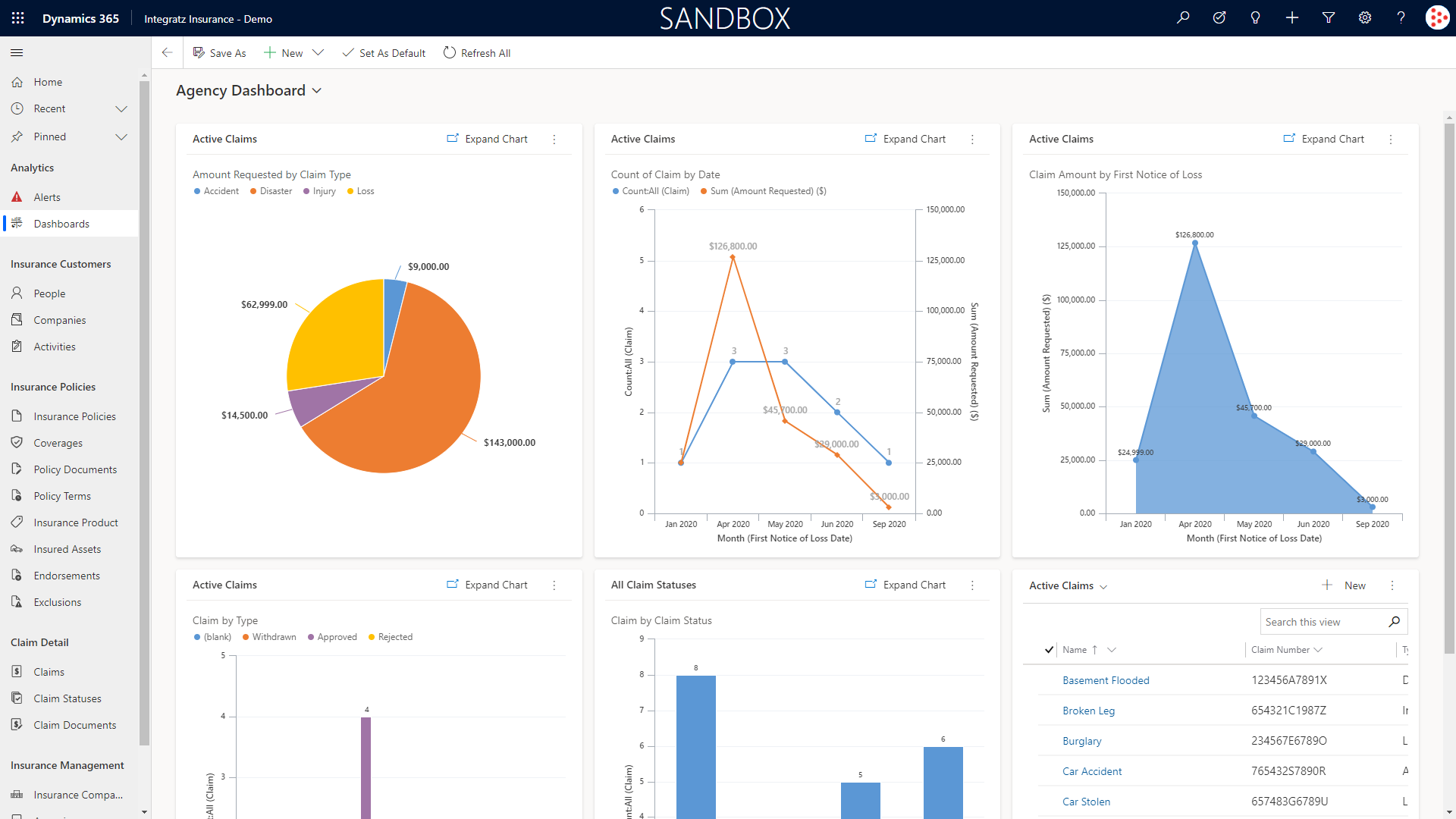

The Insurance Accelerator is a pre-built data model intended to help customers more quickly build new insurance-based applications. It includes a wide array of pre-built applications for everything from policy management and active claims to customer onboarding and customer service. It also provides Power BI dashboards on policies, claims, and upcoming appointments.

A few benefits of using the out-of-the-box Insurance Accelerator:

A few benefits of using the out-of-the-box Insurance Accelerator:

- Dashboards can be created for management to visualize agent progress

- Prebuilt common data model entities for the insurance industry such as policies and coverages, policy documents and terms, insurance products, insured assets, endorsements, claims, exclusions, agencies, contracts, and more.

- Gives better overall picture of how many claims have been approved or rejected

- Self-service for customers to submit a claim or update their information

With this tool, the customer has access to a front-facing chat feature in which they can submit any needed documentation for submitting a claim. To begin, the customer gives their personal information via the chat bot - this allows the bot to find the customer in its records and begin building a case. As soon as the customer submits all the needed information, their case is updated and can be tracked by the agent, who also has easy access to other relevant customer info.

The Insurance Accelerator also has other useful features, like integrated AI-driven recommendations that offer insight into the customer’s address and what their location may or may not qualify them for.

Read more in our blog: Insurance Use Cases: Microsoft for Business Process Automation

Best features available through Dynamics 365 for Insurance Agents

There are many benefits an Insurance Agent can get by using the Dynamics 365 platform, such as:

- Agents can more quickly work through their active claims and better track their work in progress at a glance. When everything is centralized and more intuitively located, you can spend less time looking and putting information together for the data you need.

- Establishing customized and standardized workflows. Although agents will have access to out-of-the-box insurance workflows and dashboards via the Insurance Accelerator, these components can be altered and customized to fit the unique steps of your specific process.

- Creating custom apps. With the limitless potential of Dynamics 365 and the Power Platform, custom apps can be designed to streamline daily tasks without the need for dedicated developers. Drag and drop app development allows for flexibility when designing applications so that they can provide real value to Agents.

- Utilizing a centralized knowledge base for Insurance Agents - this helps each agent better match their clients’ needs with the best available policy on the market

- Agents can search for a list of relevant customers via specific criteria. While working on their sales pipeline, an agent may want the ability to upsell a new insurance product to a list of qualified policy-holders.

Related read: How to Use Microsoft Products to Automate Insurance Processes

How to get started with Dynamics 365 for Insurance Companies

Even with out-of-the-box solutions, like the Insurance Accelerator, your company will benefit from bringing in a consultant to help integrate and adjust the existing dashboards and workflows to customize them to your organization’s way of working.

At Integratz, we can help you assess what your processes are, how they can be standardized, and how to translate that into a workflow within Dynamics 365.

Schedule a consultation with us today so you can get started on streamlining your insurance company to be more efficient and better prepared for the future.

Integrātz is Dallas-based high-performance IT consulting and automation company specializing in AI-powered automation, systems integration, and data orchestration. Established in 2017, the company helps enterprises unlock agility, efficiency, and competitive advantage without costly system overhauls.

With global delivery capabilities and a nearshore hub in Viña del Mar, Chile, Integrātz partners with organizations at every stage of digital maturity to drive meaningful, measurable transformation.